inter-sites.ru

News

Crude Oil Live Chart

Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , ; Gasoline, , + Interactive Chart for WTI Oil (CL) live spot price. Analyze financial data WTI Crude Oil Forecasts · S&P Forecasts · EUR/USD Forecasts · BDSwiss. This page contains free live Crude Oil WTI Futures streaming chart. The chart is intuitive yet powerful, customize the chart type to view candlestick patterns. WTI Crude News Oil prices experienced a sharp decline over the past week, with Brent crude falling below $ per barrel. This represents Oil prices in. Crude Oil Prices Charts. Latest News on Oil, Energy and Petroleum Prices. Articles, Analysis and Market Intelligence on the Oil, Gas, Petroleum and Energy. Current West Texas Intermediate Crude Oil (WTI) Prices. Close Date, Price per gallon Barrel, Published Consecutive Days Toward Higher Threshold, Within. Live interactive chart of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel. The current price of WTI crude oil as of August 23, is Oops looks like chart could not be displayed! Please contact cnbc oil down for a fifth session CNBC Video August 22, inter-sites.ru U.S. crude. Crudeoil Price Today: Latest Crudeoil rate/price in India, Bullion stock quote, Live Crudeoil News, Updates, Price Chart, Lot Size, Crudeoil MCX Price, Price. Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , ; Gasoline, , + Interactive Chart for WTI Oil (CL) live spot price. Analyze financial data WTI Crude Oil Forecasts · S&P Forecasts · EUR/USD Forecasts · BDSwiss. This page contains free live Crude Oil WTI Futures streaming chart. The chart is intuitive yet powerful, customize the chart type to view candlestick patterns. WTI Crude News Oil prices experienced a sharp decline over the past week, with Brent crude falling below $ per barrel. This represents Oil prices in. Crude Oil Prices Charts. Latest News on Oil, Energy and Petroleum Prices. Articles, Analysis and Market Intelligence on the Oil, Gas, Petroleum and Energy. Current West Texas Intermediate Crude Oil (WTI) Prices. Close Date, Price per gallon Barrel, Published Consecutive Days Toward Higher Threshold, Within. Live interactive chart of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel. The current price of WTI crude oil as of August 23, is Oops looks like chart could not be displayed! Please contact cnbc oil down for a fifth session CNBC Video August 22, inter-sites.ru U.S. crude. Crudeoil Price Today: Latest Crudeoil rate/price in India, Bullion stock quote, Live Crudeoil News, Updates, Price Chart, Lot Size, Crudeoil MCX Price, Price.

View live CFDs on WTI Crude Oil chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , ; Gasoline, , + Brent crude oil (USD/bbl). Scale to Fit. Relative Change. Moving Average. 20, 50, Visible chart range: - Name, Change, First, Last. International Crude Oil Price: Get all Live information on the Price of Crude Oil including News, Charts, technical analysis and Quotes on Moneycontrol. Follow live oil prices with the interactive chart and read the latest crude oil news, analysis and crude oil forecasts for expert trading insights. Live Price of Crude Oil. Crude Oil Live Chart, Intraday & Historical Chart. Crude Oil Buy & Sell Signal and News & Videos, Crude Oil Averages. Live Crude Oil Futures chart. Plus all major currency pairs, realtime Indices Charts, Commodities Charts, Futures Charts and more. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes. WTI Crude Oil Futures Advanced Chart Live · West Texas Intermediate (WTI) Crude Oil Live Streaming Quotes · Post navigation. Dow Jones Live Chart · NYMEX. Control a large contract value with a small amount of capital. Used properly, futures are a powerful way to increase capital efficiency and exposure. NOW LIVE. Crude Oil WTI (NYM $/bbl) Front Month ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. % ; 3 Month. %. Crude Oil - data, forecasts, historical chart - was last updated on August 26 of Crude Oil increased USD/BBL or % since the beginning of OPEC Oil Reserves · Historical Production Data · Home Data / Graphs As of January The Venezuelan crude "BCF" was replaced by the crude "Merey". Crude Oil Oct 24 (CL=F). Follow. + (+%). As of PM EDT. Market Advanced Chart. Loading Chart for CL=F. 9/21 PM. DELL. Date. Close. Crude Oil Price Chart. Home» Live Charts» Commodities» Energy & Oil» Crude Oil Price Chart. USOIL Chart by TradingView. Current WTI Crude Price Chart Live. Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. Find the latest Crude Oil Oct 24 (CL=F) stock quote, history Chart · Historical Data · Futures. NY Mercantile - Delayed Quote • USD. Crude Oil Oct 24 (CL=F). WTI CRUDE OIL Chart: historical data with all timeframes. Add your technical indicators and realize your analysis plots. Live interactive chart of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes Bloomberg Live Conferences · Bloomberg Radio.

Can You Pay Yourself In An Llc

When an LLC is taxed as a corporation, owners can pay themselves a salary from the LLC's income. This method is a bit more complicated than the owner's draw. First assuming you have a single member LLC, taxed as a disregarded entity, you never pay yourself a paycheck. All the profits of the LLC are. File a w4 for yourself and add yourself to your LLC's payroll. If you have a business account with any banks, they offer simple payroll service. Owner's draws can be confusing at first. Here's how I pay myself 50% of the money my single-member LLC makes, using online bank transfers. Since you formed your company as a limited liability company, as the owner you are considered a “member” of the LLC by the Internal Revenue Service. If you're a. Single-member and multi-member LLC owners pay themselves by taking what's known as an owner's draw (I'll explain what that is in a bit). Corporation LLC. Depending on whether the multimember LLC is classified as a partnership or a corporation, the owners of a multimember LLC can take an owner's draw or they can. If you form an LLC and do not elect to be considered an S corp or C corp, you will be classified as your business' sole proprietor by the IRS. This means you. An LLC owner can be paid by way of a profit distribution. This is a method in which profits from the business are distributed to its owners. When an LLC is taxed as a corporation, owners can pay themselves a salary from the LLC's income. This method is a bit more complicated than the owner's draw. First assuming you have a single member LLC, taxed as a disregarded entity, you never pay yourself a paycheck. All the profits of the LLC are. File a w4 for yourself and add yourself to your LLC's payroll. If you have a business account with any banks, they offer simple payroll service. Owner's draws can be confusing at first. Here's how I pay myself 50% of the money my single-member LLC makes, using online bank transfers. Since you formed your company as a limited liability company, as the owner you are considered a “member” of the LLC by the Internal Revenue Service. If you're a. Single-member and multi-member LLC owners pay themselves by taking what's known as an owner's draw (I'll explain what that is in a bit). Corporation LLC. Depending on whether the multimember LLC is classified as a partnership or a corporation, the owners of a multimember LLC can take an owner's draw or they can. If you form an LLC and do not elect to be considered an S corp or C corp, you will be classified as your business' sole proprietor by the IRS. This means you. An LLC owner can be paid by way of a profit distribution. This is a method in which profits from the business are distributed to its owners.

If you are reporting your business income and expenses on Schedule C, you write yourself a check and call it “member's draw”. You will pay. As an owner of an LLC, you'll pay yourself with an owner's draw. To If you'd prefer to pay yourself a salary or wages as an LLC owner, this option. The two ways to pay yourself in an LLC are through the LLC's profits and as an employee. If you choose to pay yourself via profits, then it is important that. Another way to pay yourself from your LLC is to take a salary or give yourself a wage. This is similar to how traditional employees are paid, and it can be a. In the eyes of the IRS, you're not an employee—and you don't get a salary through payroll. Instead, you're essentially taxed as a self-employed business owner. As an LLC owner, you can be taxed as a sole proprietorship (if you are the LLC's sole member), a partnership (if your LLC has two or more members), or a. You can simply write a check or transfer money from your business account to your personal account at any time you want. How To Pay Taxes. The IRS regulates tax. For federal income tax purposes, an LLC can be taxed as a pass-through entity or as an S-Corporation. S-Corp status can result in lower taxes than a. By default, the IRS treats single-member LLCs as if they were sole proprietors and taxes them the same way. However, if you are the only owner of your LLC, you. Under these circumstances, to pay yourself as an LLC owner, you don't get a salary or a paycheck. If you're a one-member LLC, you just withdraw money from the. Things to Consider When Paying Yourself in a Single Member LLC. You fill out a check and then you write it to yourself however much you want to pay yourself. In general, there are two ways you can get paid from your LLC: by taking a salary or an owner's draw. Different forms of small business ownership may warrant a. Single and multi-member LLC owners can choose to pay themselves through an owner's draw. If your LLC is taxed as a corporation, you can pay yourself a salary. Single-member and multi-member LLC owners pay themselves by taking what's known as an owner's draw (I'll explain what that is in a bit). Corporation LLC. The procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. As an employee, you can be paid a salary. This works the same for the LLC member as for any other employee. You set the wage you want to pay yourself and. How Much Should You Pay Yourself? The IRS requires that owners who work for an LLC pay themselves a "reasonable amount" before they can take an owner's draw. You'll want to keep careful records of your business income because, as with a sole proprietorship, you will still owe taxes on your income. You can pay. Single and multi-member LLC owners can choose to pay themselves through an owner's draw. If your LLC is taxed as a corporation, you can pay yourself a salary.

War Galaxie

Composed of some four hundred billion stars in a disk , light-years in diameter, the galaxy was orbited by seven smaller satellite galaxies, of which five. This will be a day long remembered! The Star Wars™ Galaxy Box is the must-have mystery box for any Jedi (or Sith)! Every three months, you'll receive a new. Listen to Galaxy on Spotify · Album · War · · 5 songs. Explore the worlds and systems of Star Wars, from the icy tundra of Hoth to the deserts of Tattooine, in this interactive experience built by nclud. A Star Wars: Galaxy of Heroes podcast that's better than some and worse than others. Each week, we bring you news, analysis, strategy, and a look at the. The official site for Star Wars, featuring the latest news on Star Wars movies, series, video games, books, and more. View credits, reviews, tracks and shop for the Vinyl release of "Galaxy" on Discogs. Prepare to immerse yourself in Star Wars: Galaxy's Edge, an out-of-this-world land featuring 'Star Wars' themed attractions, entertainment. Join the champions of the holotables with your squad of iconic heroes in an epic turn-based RPG. Galactic combat awaits! - Unlock legendary Star Wars™ heroes. Composed of some four hundred billion stars in a disk , light-years in diameter, the galaxy was orbited by seven smaller satellite galaxies, of which five. This will be a day long remembered! The Star Wars™ Galaxy Box is the must-have mystery box for any Jedi (or Sith)! Every three months, you'll receive a new. Listen to Galaxy on Spotify · Album · War · · 5 songs. Explore the worlds and systems of Star Wars, from the icy tundra of Hoth to the deserts of Tattooine, in this interactive experience built by nclud. A Star Wars: Galaxy of Heroes podcast that's better than some and worse than others. Each week, we bring you news, analysis, strategy, and a look at the. The official site for Star Wars, featuring the latest news on Star Wars movies, series, video games, books, and more. View credits, reviews, tracks and shop for the Vinyl release of "Galaxy" on Discogs. Prepare to immerse yourself in Star Wars: Galaxy's Edge, an out-of-this-world land featuring 'Star Wars' themed attractions, entertainment. Join the champions of the holotables with your squad of iconic heroes in an epic turn-based RPG. Galactic combat awaits! - Unlock legendary Star Wars™ heroes.

Listen to Galaxy on Spotify. Song · War ·

The Galaxy Far, Far Away: map; layers. Units are measured in parsecs. Each grid square is parsecs on a side. Star Wars is a trademark and copyright of. Explore one of the largest private single collections of Star Wars memorabilia in the world showcasing exhibits in 22 scenes. Galaxy Tracklist · Galaxy Lyrics · Baby Face Lyrics · Sweet Fighting Lady Lyrics · Hey Señorita Lyrics · The Seven Tin Soldiers Lyrics · Evolutionary · The Hits. It is implied that Star Wars takes places in the same Universe as us, simply “In a Galaxy far, far away”. So, it is likely that it is the same. Galaxy Tracklist · Galaxy Lyrics · Baby Face Lyrics · Sweet Fighting Lady Lyrics · Hey Señorita Lyrics · The Seven Tin Soldiers Lyrics · Evolutionary · The Hits. Galaxy by War released in Find album reviews, track lists, credits, awards and more at AllMusic. Subscribe to download. Star Wars - Galaxy At War - v Galaxy At War, is a Star-Wars themed mod being built for GEM2. Galaxy At War aims to bring a well. Galaxy Wars This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced. The Galaxy Far, Far Away: map; layers. Units are measured in parsecs. Each grid square is parsecs on a side. Star Wars is a trademark and copyright of. Galaxy War is a Simulation Game. r/swg: A place for everything Star Wars Galaxies. Welcome to r/swg! This subreddit is for SWG discussion in all of its different incarnations. This. Galaxy At War Online. likes. Galaxy at war is an epic planetary strategy game. Build your base, upgrade your battleships and fight. About this game Galaxy Wars - Ice Empire is an amazing strategic game of space combat. Command your agar ships with a simple touch, destroy enemies and. The galaxy is getting bigger with our expansion to PC! Experience the game you know and love on a bigger screen. Join the Early Access period on EA App for. The first-ever open world Star Wars game was released on June 26, , to much critical acclaim, it spawned three expansions through The game was. Get ready for 'Star Wars': Galaxy's Edge—an out-of-this-world land in Disneyland Park at the Disneyland Resort, located in Anaheim, California, where you're. War · 1. Galaxy. War. · 2. Baby Face. War. · 3. Sweet Fighting Lady. War. · 4. Hey Senorita. War. · 5. The Seven Tin Soldiers. War. The official site for Star Wars, featuring the latest news on Star Wars movies, series, video games, books, and more. Play now Galaxy Wars for free on LittleGames. Galaxy Wars unblocked to be played in your browser or mobile for free.

What A Ci

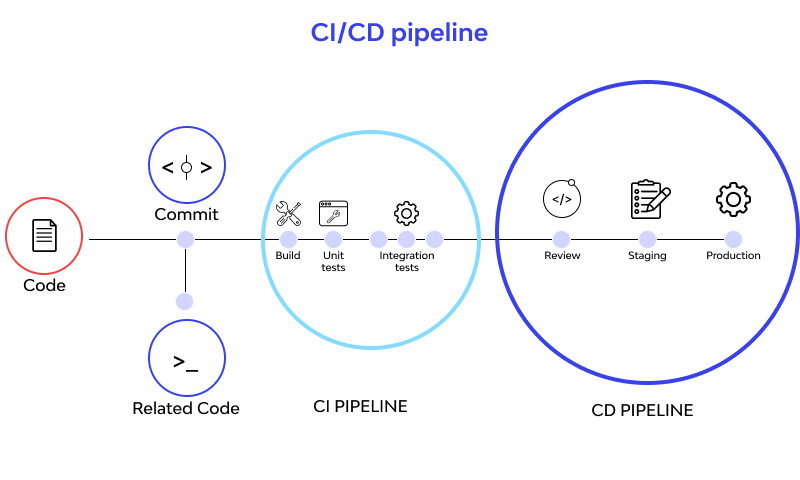

A CI/CD pipeline is an automated process utilized by software development teams to streamline the creation, testing and deployment of applications. "CI". CI/CD Best Practices · Commit early, commit often · Keep the builds green · Build only once · Streamline your tests · Clean your environments · Make it the only. This guide answers what is continuous integration, how it ties in with continuous deployment and continuous delivery and how to get started with these. A Continuous Integration/Continuous Deployment (CI/CD) pipeline automates software delivery processes. It builds code, runs tests, and securely deploys a. A CI is a confidential informant, a person who tells you something about someone's violation of the law but does not want the defendant to know. In application development and operations (DevOps), CI/CD streamlines application coding, testing and deployment by giving teams a single repository for storing. Continuous integration (CI) is a software development strategy that improves both the speed and quality of code deployments. In CI, developers frequently. Continuous integration (CI) is a software development practice in which developers merge their changes to the main branch many times per day. Each merge. CI and CD stand for continuous integration and continuous delivery/continuous deployment. In very simple terms, CI is a modern software development practice. A CI/CD pipeline is an automated process utilized by software development teams to streamline the creation, testing and deployment of applications. "CI". CI/CD Best Practices · Commit early, commit often · Keep the builds green · Build only once · Streamline your tests · Clean your environments · Make it the only. This guide answers what is continuous integration, how it ties in with continuous deployment and continuous delivery and how to get started with these. A Continuous Integration/Continuous Deployment (CI/CD) pipeline automates software delivery processes. It builds code, runs tests, and securely deploys a. A CI is a confidential informant, a person who tells you something about someone's violation of the law but does not want the defendant to know. In application development and operations (DevOps), CI/CD streamlines application coding, testing and deployment by giving teams a single repository for storing. Continuous integration (CI) is a software development strategy that improves both the speed and quality of code deployments. In CI, developers frequently. Continuous integration (CI) is a software development practice in which developers merge their changes to the main branch many times per day. Each merge. CI and CD stand for continuous integration and continuous delivery/continuous deployment. In very simple terms, CI is a modern software development practice.

CI/CD is a set of processes that help software development teams deliver code changes more frequently and reliably. CI servers, also known as a build server or continuous integration server, help developers build and test important changes before they get released. A CI/CD pipeline is a deployment pipeline integrated with automation tools and improved workflow. If conducted properly, it will minimize manual errors and. Continuous integration is a DevOps software development practice where developers regularly merge their code changes into a central repository. CI/CD is the software that takes the source code repository, and newly pushed changes, and builds it and runs tests and/or deploys the changes. Continuous Integration (CI) is a development practice where developers integrate code into a shared repository frequently, preferably several times a day. Best CI/CD Tools: ✔️Jenkins ✔️CircleCI ✔️TeamCity ✔️Bamboo ✔️Gitlab ✔️Buddy ✔️Travis CI ✔️Codeship ✔️GoCD ✔️Wercker ✔️Semaphore and more! Continuous integration (CI) is a software development process where developers integrate new code into the code base throughout the development cycle. CI/CD is the combined practices of continuous integration (CI) with continuous delivery or continuous deployment (CD). The purpose of CI/CD is to allow. What is CI/CD? It is the acronym used in software development for the combination of continuous integration (CI) and continuous delivery (CD). Continuous integration (CI) is a software development practice in which frequent and incremental changes are routinely added or integrated to the complete. Continuous Integration and Continuous Delivery (CI/CD) are terms used to describe a process where multiple changes are made to a codebase simultaneously. A CI/CD environment is a type of production environment in which ongoing automation and monitoring are implemented to improve and expedite development processes. A CI/CD pipeline is a software delivery process used to deploy new and updated software safely by combining automated code building and testing with. A CI/CD pipeline for a simple program typically involves stages like source, build, test, and deploy. Developers commit code to a version control system like. So, what is a CI? CI is continuous integration, which means individual code changes from multiple developers are systematically integrated into one software. Step-by-Step Guide to Creating a Basic CI/CD Pipeline · Start by creating a Git repository to store your source code. · Define a branching. CI/CD Tools · Jenkins: An open source CI automation server, is one of the leading continuous delivery and continuous integration tools on the market. · GitLab. CI and CD are two acronyms frequently used in modern development practices and DevOps. CI stands for continuous integration, a fundamental DevOps best. A CI/CD pipeline is a series of steps that streamline the software delivery process. Via a DevOps or site reliability engineering approach, CI/CD improves app.

Kuwait Money Value

United States dollar to Kuwaiti dinar (USD to KWD) Quickly and easily calculate foreign exchange rates with this free currency converter. Updated | Thu (Rate against KD). More · EXCEL · XML. US Dollar; Fils/Unit; Change; % change. EURO; Fils/Unit. 1 KWD = USD Sep 13, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. The current rate of Kuwaiti dinar is INR (0). You can keep an eye on the live kuwaiti dinar value in order to know Kuwaiti dinar Indian price. History of. 1 KWD = USD Sep 18, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Kuwaiti Dinar to US Dollar (KWD to USD) · Money Transfer Rate · Currency Exchange Rate · Join Our Community · Download the New BEC App · Cookie Settings Center. Download Our Currency Converter App ; 1 USD, KWD ; 5 USD, KWD ; 10 USD, KWD ; 20 USD, KWD. As of , the Kuwaiti dinar is the currency with the highest value per When Iraq invaded Kuwait in , the Iraqi dinar replaced the Kuwaiti dinar. Convert Kuwaiti Dinar to US Dollar ; 1 KWD. USD ; 5 KWD. USD ; 10 KWD. USD ; 25 KWD. USD ; 50 KWD. USD. United States dollar to Kuwaiti dinar (USD to KWD) Quickly and easily calculate foreign exchange rates with this free currency converter. Updated | Thu (Rate against KD). More · EXCEL · XML. US Dollar; Fils/Unit; Change; % change. EURO; Fils/Unit. 1 KWD = USD Sep 13, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. The current rate of Kuwaiti dinar is INR (0). You can keep an eye on the live kuwaiti dinar value in order to know Kuwaiti dinar Indian price. History of. 1 KWD = USD Sep 18, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Kuwaiti Dinar to US Dollar (KWD to USD) · Money Transfer Rate · Currency Exchange Rate · Join Our Community · Download the New BEC App · Cookie Settings Center. Download Our Currency Converter App ; 1 USD, KWD ; 5 USD, KWD ; 10 USD, KWD ; 20 USD, KWD. As of , the Kuwaiti dinar is the currency with the highest value per When Iraq invaded Kuwait in , the Iraqi dinar replaced the Kuwaiti dinar. Convert Kuwaiti Dinar to US Dollar ; 1 KWD. USD ; 5 KWD. USD ; 10 KWD. USD ; 25 KWD. USD ; 50 KWD. USD.

Right now, 1 PayPal USD is worth about KWD How much PYUSD could I buy for 1 KWD? Based on the current rate, you could get PYUSD. Kuwaiti Dinar to US Dollar conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject. 00 kuwaiti dinars for $ us dollar, which is $ less than it is now. Over the last 7 days, the best beneficial exchange rate was $ Be on the lookout. Download Our Currency Converter App ; 1 KWD, USD ; 5 KWD, USD ; 10 KWD, USD ; 20 KWD, USD. As of , the Kuwaiti dinar is the highest value currency with a value range of x-3x as compared to the US Dollar (USD), euro (EUR) and sterling (GBP). Convert Kuwaiti Dinar to US Dollar ; 1 KWD. USD ; 5 KWD. USD ; 10 KWD. USD ; 25 KWD. USD ; 50 KWD. USD. Currently, one Kuwait Dinar (KWD) = US$ While the KWD tends to vary with the price of oil, it has the highest value per one US dollar for a. As of July , one Kuwaiti dinar is worth about $, making it one of the most valuable currencies in the world The State of Kuwait has a petroleum. Kuwait Exchange Rate against USD averaged (USD/KWD) in Jun , compared with USD/KWD in the previous month. Latest Currency Exchange Rates: 1 US Dollar = Kuwaiti Dinar · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Kuwaiti Dinar (KWD). Kuwaiti Dinar, KWD, inv. KWD. US Dollar, · Euro, · British Pound, · The USDKWD decreased or % to on Friday September 13 from in the previous trading session. Kuwaiti Dinar - values, historical data. Further Information Kuwaiti Dinar - United States Dollar ; Close, , Open, · Date ; KWD · , , USD ; USD · , , KWD. KWD to INR Currency Converter with Live Rate · 1 KWD = ₹ INR · 1 Kuwaiti Dinar To Indian Rupee Stats. Latest Currency Exchange Rates: 1 Kuwaiti Dinar = US Dollar · Currency Converter · Exchange Rate History For Converting Kuwaiti Dinar (KWD) to Dollars (USD). Amount. Date. Submit; Reset. Disclaimer: This currency exchange rates service was provided by the Central Bank of Kuwait website upon request without. The Kuwaiti Dinar rate in India today keeps varying and is not fixated in nature. The rates keep changing with time and customers have the flexibility to easily. We make an average of 25 transfers per second and move money from Kuwait to over countries and territories. amount sent, destination country. 10 Fils coin Kuwait. The 10 fils coin from Kuwait is made of copper clad steel. The 10 fils piece has a value equivalent to dinar. This is because the. Ever since oil was discovered in Kuwait, there has been a LOT of expat workers in the oil industry, and as a result, the currency is accepted by.

What Is Variable Costing

Variable costs are expenses that vary in proportion to the volume of goods or services that a business produces. Variable cost (definition). Variable costs are expenses that go up and down in line with business activity. The busier you are, the higher they go. They're the. Variable costing includes the variable costs directly incurred in production and none of the fixed costs. For reporting purposes, absorption costing is required. Variable cost is the expense incurred by a company that changes with change in production and sales. It is contrasted with fixed cost. Absorption costing does not support CVP analysis because it essentially treats fixed manufacturing overhead as a variable cost by. Under absorption costing, normal manufacturing costs are considered product costs and included in inventory. Variable costs are the expenses a business incurs that change with the amount of goods produced or services provided. In some accounting statements, the Variable costs of production are called the “Cost of Goods Sold.” It is possible for a cost to be fixed for some kinds of. Variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense in the period received. Variable costs are expenses that vary in proportion to the volume of goods or services that a business produces. Variable cost (definition). Variable costs are expenses that go up and down in line with business activity. The busier you are, the higher they go. They're the. Variable costing includes the variable costs directly incurred in production and none of the fixed costs. For reporting purposes, absorption costing is required. Variable cost is the expense incurred by a company that changes with change in production and sales. It is contrasted with fixed cost. Absorption costing does not support CVP analysis because it essentially treats fixed manufacturing overhead as a variable cost by. Under absorption costing, normal manufacturing costs are considered product costs and included in inventory. Variable costs are the expenses a business incurs that change with the amount of goods produced or services provided. In some accounting statements, the Variable costs of production are called the “Cost of Goods Sold.” It is possible for a cost to be fixed for some kinds of. Variable costing (also known as direct costing) treats all fixed manufacturing costs as period costs to be charged to expense in the period received.

A variable cost is an expense that changes in proportion to production or sales volume.

Variable Cost: Definition, Formula, and Examples · Variable costs are any expense that increases or decreases with your production output. · Examples of. A costing method that includes all variable manufacturing costs in inventory until the goods are sold (just like absorption costing) but reports all fixed. A variable cost is an expense that varies according to production output or sales. · Variable expenses rise in response to rising output or sales and fall in. A variable cost is a cost that changes with the level of output or production. In other words, it is a cost that increases as production increases and decreases. Variable costing is a managerial accounting cost concept. Under this method, manufacturing overhead is incurred in the period that a product is produced. Variable costs are costs that change depending on the level of production a business has. These changes could be due to the need for more raw material, less. There are three accounting approaches used to assign costs for income statement reporting purposes: absorption costing, variable costing, and throughput. 1. Explain how variable costing differs from absorption costing and compute unit product costs under each method. 2. Prepare income statements using both. Other articles where variable costing is discussed: accounting: Cost finding: can also be adapted to variable costing in which only variable manufacturing. Variable costing, also known as direct costing or marginal costing, is a costing method where only the variable costs of production are allocated to the. Variable costing is an accounting method that includes only variable production costs, such as direct materials and direct labor, in the cost of a product. It. Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs. A variable cost is an expense that changes with the amount of goods produced or services provided. Variable costs are the expenses a business incurs that. What is Variable Costing? Home › Accounting›Cost Accounting›What is Variable Costing? Definition: Variable costing, also called direct costing, is an accounting. Variable costs are the costs incurred by a company that depends on revenue generated or production quantity. If a company has high variable costs. The key difference between variable and absorption costing lies in the treatment of fixed manufacturing overhead costs. Under variable costing, these costs are. Variable costing has distinct advantages for internal planning and assessment, but you can't use it for your external financial reporting. The formula for variable costs is: total quantity of output X variable cost per unit of output = variable cost. A business would need to find this data for a. The difference between the absorption costing and variable costing methods is solely in the treatment of fixed manufacturing overhead costs and income. An employee's salary would be considered a fixed cost, while sales commissions are variable. While fixed costs do change over a long-term period, this change.

How Much To Send A Car To Another State

However, the further you ship a car, the cheaper it will be per mile. Almost all car shipments will cost between $ and $ for each mile traveled. If your. Distance - The range for shipping a car is rather large. It might be anywhere from miles to over 2, miles. In general, the price per mile increases to. On average, you can expect to pay between $ and $2, for a standard car shipment across the country. The transporter will drive the truck carrying your vehicle a long distance across the country to where you want it delivered. Once transported, you can review. The easiest and best way to find out is by getting the cost to ship from our calculator. For the most part, car shipping will range from $ to $ when. Option #1: Drive it Yourself · Option #2: Hire a Driver · Option #3: Tow or Trailer Your Car · Option #4: Transport Your Car with Your Moving Company · Option #5. The cost of state-to-state car shipping averages between $ to $1, for short distances. For longer car shipping orders of miles, you could pay. Ship a car to another state. Ship from/to any state · Snowbird car shipping How much does car shipping cost? Car shipping costs in , specifically. On average, the cheapest vehicle transport costs $ per mile if you're shipping a car 2, miles or more. For distances of less than miles, the cost is. However, the further you ship a car, the cheaper it will be per mile. Almost all car shipments will cost between $ and $ for each mile traveled. If your. Distance - The range for shipping a car is rather large. It might be anywhere from miles to over 2, miles. In general, the price per mile increases to. On average, you can expect to pay between $ and $2, for a standard car shipment across the country. The transporter will drive the truck carrying your vehicle a long distance across the country to where you want it delivered. Once transported, you can review. The easiest and best way to find out is by getting the cost to ship from our calculator. For the most part, car shipping will range from $ to $ when. Option #1: Drive it Yourself · Option #2: Hire a Driver · Option #3: Tow or Trailer Your Car · Option #4: Transport Your Car with Your Moving Company · Option #5. The cost of state-to-state car shipping averages between $ to $1, for short distances. For longer car shipping orders of miles, you could pay. Ship a car to another state. Ship from/to any state · Snowbird car shipping How much does car shipping cost? Car shipping costs in , specifically. On average, the cheapest vehicle transport costs $ per mile if you're shipping a car 2, miles or more. For distances of less than miles, the cost is.

Transport a car to another state with Nexus Auto Transport. Step 1. Grab Your Instant Car Shipping Quote. The cost of car transport can change daily, so we. However, four-door sedans typically cost between $$1, to transport, while small vans, pickup trucks, and SUVs generally cost between $ and $1, You. In open car shipping, the cost averages around $ per mile, while enclosed transport tends to be % more expensive due to the added security, ranging up. The first step in moving car state to state with Shipaa is to submit a request online. Simply provide us with your pick-up and delivery locations and any. Typical cost of shipping from coast to coast is at least $. Will be cheaper for closer moves; however, expect there to be a large base price. Ship a car to another state. Ship from/to any state · Snowbird car shipping How much does car shipping cost? Car shipping costs in , specifically. For the first miles, the average rate is typically $ per mile, so a mile trip down the coast might cost $ The longer the distance, the. How much does it cost to ship a car enclosed? For a vehicle going state to state can average of $ or less per mile, depending on distance. This can also be. Shipping a Car to Another State · Be Prepared With a Schedule · Choose the Type of Carrier for Transport · What Does It Cost to Ship a Car? · Prepare Your Car for. The price also depends on where in the state you are shipping from and where you are sending your vehicle. You can do it within $1, if you are doing open. For the first miles, the average rate is typically $1 per mile, so a mile trip down the coast might cost $ The longer the distance, the lower. Interstate car transport costs vary depending on factors like shipping distance, vehicle type, and transport method. Prices range from $ to $2, on average. The first step in moving car state to state with Shipaa is to submit a request online. Simply provide us with your pick-up and delivery locations and any. How to Ship a Car to Another State · Hire a Moving or Auto Transport Company · Hitch It To Your Trailer · Hire a Driver · Send It By Train · Drive It Yourself · How. car transport, or just to transport a car to another state. This is often preferable as it means you do not need to get anywhere to then pick up your. Interstate car shipping can cost anywhere from $ to over $1, on average. Use a car shipping calculator like the one RoadRunner offers to get an accurate. The average out-of-pocket cost of you moving your vehicle to your new home will be around $ to $ So, hiring a professional car shipping company would be. Auto transport by road, Auto transport services by state, state to state car shipping How much does it cost to ship a car to another state? First, we want to. Average Car Shipping Prices To Ship A Luxury Vehicle · Shipping a car from California to New York - $1, · Shipping a car from Seattle to Texas - $1, The average cost of shipping a car from one state to another is $ per mile for 1, – 1, miles. The shipping car price to another state depends on.

Water Loss Insurance

According to the Insurance Information Institute, the cost for water damage repair is around $7, per claim. While an average cost of $7, may seem high, it. A standard homeowners policy might cover water-related claims if they're sudden and accidental. Typically, coverage is limited based on the source of the water. Depending on how the water damage occurs, homeowners insurance may cover water damage from rain. Flooding typically won't be covered by standard homeowners. They are assuming the water has been slowly leaking into the wall/floor for an extended period (more than 14 days) and is therefore not covered. We can help you protect your priceless possessions, memories and time with this guide to water damage prevention options. Property insurance often does not cover water damage. HUB can help you craft a customized water damage insurance policy for your property's needs. Our hidden water damage coverage helps repair water damage caused by a hidden leak you can't see within walls, floors and behind home appliances. Most homeowners insurance policies typically cover water damage if the cause is sudden and accidental. Your standard homeowners insurance policy will cover the costs associated with the damage and an agent can help you start the process of filing a water damage. According to the Insurance Information Institute, the cost for water damage repair is around $7, per claim. While an average cost of $7, may seem high, it. A standard homeowners policy might cover water-related claims if they're sudden and accidental. Typically, coverage is limited based on the source of the water. Depending on how the water damage occurs, homeowners insurance may cover water damage from rain. Flooding typically won't be covered by standard homeowners. They are assuming the water has been slowly leaking into the wall/floor for an extended period (more than 14 days) and is therefore not covered. We can help you protect your priceless possessions, memories and time with this guide to water damage prevention options. Property insurance often does not cover water damage. HUB can help you craft a customized water damage insurance policy for your property's needs. Our hidden water damage coverage helps repair water damage caused by a hidden leak you can't see within walls, floors and behind home appliances. Most homeowners insurance policies typically cover water damage if the cause is sudden and accidental. Your standard homeowners insurance policy will cover the costs associated with the damage and an agent can help you start the process of filing a water damage.

Cincinnati works with vendors to offer our policyholders preferred pricing for water shut-off devices. Visit our preferred vendor sites to learn more about. Average repair costs for water damage · $3, Burst pipes · $7, Sink-related water damage · $2,$10, Malfunctioning toilets · $4,$7, Basement. File a property claim or call A leaking hot water heater or burst water pipe can quickly damage your home and belongings. Condo insurance may help cover the damage if water damage stems from an adjoining unit. Your condo insurance company might reimburse you for repairs and recoup. Determine if your water damage is covered by your home insurance policy. Call your insurance agent and report the claim. If needed, hire a professional water. Renters insurance typically won't cover water damage caused by negligence, a sewer backup, or a flood. A homeowners insurance policy may cover water damage if the cause was sudden, like a burst pipe. Learn more about what a home policy may cover from the. How Does Water Damage Legal Liability Insurance Work? Typically, water damage legal liability insurance protects you if water damage results from a sudden event. Most HO3 homeowners policies cover water damage caused by a burst pipe as long as the incident is sudden and accidental. If water damage occurs outside of your. In most cases, your home insurance policy will cover water damage that is caused by three types of appliance/plumbing problems. Most home owners insurance policies will cover water damage if it is sudden and accidently. Examples of this would be damage caused by rain, snow, or frozen. Most home owners insurance policies will cover water damage if it is sudden and accidently. Examples of this would be damage caused by rain, snow, or frozen. Accidental water damage that occurs as a result of a sudden, unexpected occurrence like a burst pipe is often covered by a homeowners insurance policy. Learn. Insurers frequently deny such claims, but they have a duty to investigate and identify evidence that supports coverage. The only water coverage that comes included on most basic homeowners' policy is called sudden and accidental water damage. Generally speaking, water damage may be covered under your home insurance policy if the damage is “sudden and accidental.” For example, damage from a frozen. From finding the source of water and starting the restoration process to filing a claim with your insurer, there are steps to follow that are critical to. Your homeowners insurance policy covers damage to your home from water in certain circumstances, but may require purchasing additional coverage. Most standard homeowners insurance policies exclude certain water damage types like flooding or sewage backup, there is still coverage for other water-related. Standard homeowners insurance covers several types of water damage, most of which are considered sudden and accidental.

Pay Tax Brackets

You can use the Tax Withholding Estimator to estimate your income tax for next year. The Tax Withholding Estimator compares that estimate to your current tax. You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You. We have compiled the various tax brackets and marginal tax rate applicable for each bracket. Tax threshold is the minimum tax for that tax bracket. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $ Federal top rate: 33%. Provincial/territorial top rates range from % to %. Cayman Islands (Last reviewed 17 July ), NA. View benefit payment schedule Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status. You can use the Tax Withholding Estimator to estimate your income tax for next year. The Tax Withholding Estimator compares that estimate to your current tax. You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You. We have compiled the various tax brackets and marginal tax rate applicable for each bracket. Tax threshold is the minimum tax for that tax bracket. The tax table can be used if your Virginia taxable income is listed in the table. Otherwise, use the Tax Rate Schedule. $ 4, – $ 5, $ Federal top rate: 33%. Provincial/territorial top rates range from % to %. Cayman Islands (Last reviewed 17 July ), NA. View benefit payment schedule Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as. In actuality, income is taxed in tiers. When your income reaches a different tier, that portion of your income is taxed at a new rate. Your marginal tax rate or. This system features seven tax brackets—or ranges of income—that are taxed at rates from 10 percent to 37 percent. The marginal tax rate is the amount of. The legislature to levy and collect taxes on taxable, individual income at a rate not to exceed 5 percent. It further provides for minimum personal exemptions. Schedule Y-1—Use if your filing status is Married filing jointly or Qualifying surviving spouse. If your taxable income is: Over--, But not over--, The tax is. Some areas may have more than one district tax in effect. Sellers are required to report and pay the applicable district taxes for their taxable sales and. REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. Oregon Personal Income Tax resources including tax rates and tables, tax calculator, and common questions and answers. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Tax Rates ; January 1, – current, % or ; January 1, – December 31, , % or ; January 1, – December 31, , % or Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, For Tax Year , the North Carolina individual income tax rate is % (). Tax rates for previous years are as follows: For Tax Years , , and. A tax bracket is a range of taxable income that is subject to a specific tax percentage. The brackets used to calculate your income tax depend on your filing. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; 1, $,, $, ; 2, $2,, $4, Self-employment tax rates, deductions, who pays and how to pay. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current.

Transfer Ownership Of Linkedin Company Page

1. Navigate to inter-sites.ru and sign in to your account. · 2. Hove your mouse pointer over "Companies," then click the company page you administer. · 3. Click ". Transfer Ownership · Select the Admin tab at the top of the page. · Select Users from the left panel. · Click the name of the account owner. · Click Transfer. I set up a company page for a client who has chosen to take over their Linkedin page. It was set up under my boss's LinkedIn account. Now that. The current account owner can transfer the ownership of the account to another administrator by visiting the other administrator's profile page, clicking on. To assign a Business Manager as a Page owner, you'll need to be both an admin of the Business Manager and have Facebook access with full control of a Page. To. OPTION ONE: · Access Facebook Meta Business Suite · Settings -> Related Business Account (that the page should be transferred to) -> Select People. Go to your Page super admin view. · Click Settings in the left menu. · Click Manage admins. · Click the Page admins or Paid media admins tab. · Click the Edit icon. Ad Account IDs are 9-digit IDs that you can find in the Accounts tab in your LinkedIn Campaign Manager. Click Add. claim ad account ownership. Success! If the. Find the organization's Page. · Click the Claim this page button in the upper-right corner. · Select the checkbox to verify that you're an authorized. 1. Navigate to inter-sites.ru and sign in to your account. · 2. Hove your mouse pointer over "Companies," then click the company page you administer. · 3. Click ". Transfer Ownership · Select the Admin tab at the top of the page. · Select Users from the left panel. · Click the name of the account owner. · Click Transfer. I set up a company page for a client who has chosen to take over their Linkedin page. It was set up under my boss's LinkedIn account. Now that. The current account owner can transfer the ownership of the account to another administrator by visiting the other administrator's profile page, clicking on. To assign a Business Manager as a Page owner, you'll need to be both an admin of the Business Manager and have Facebook access with full control of a Page. To. OPTION ONE: · Access Facebook Meta Business Suite · Settings -> Related Business Account (that the page should be transferred to) -> Select People. Go to your Page super admin view. · Click Settings in the left menu. · Click Manage admins. · Click the Page admins or Paid media admins tab. · Click the Edit icon. Ad Account IDs are 9-digit IDs that you can find in the Accounts tab in your LinkedIn Campaign Manager. Click Add. claim ad account ownership. Success! If the. Find the organization's Page. · Click the Claim this page button in the upper-right corner. · Select the checkbox to verify that you're an authorized.

Resources mentioned in this episode: Adi Klevit on LinkedIn · Business Success Consulting Group · Byron McFarland on LinkedIn · The McFarland Group · Verne. Account Owners can't change their own user type directly, but they can assign another user as an Owner. When a different user becomes the Owner, the previous. OPTION ONE: · Access Facebook Meta Business Suite · Settings -> Related Business Account (that the page should be transferred to) -> Select People. Entrepreneurs can imagine the need to transfer Facebook Page ownership upon being acquired or during any sort of business sale. Linkedin Twitter. Go to your Page super admin view. Click Settings in the left menu and select Manage admins. Click the Page admins or Paid media admins tab. Your business ownership may change if you're selling your business, transferring it to a family member or adding a new partner. If you're adding a new. Select a new owner from the member list. Select Yes to make that member the owner of the group. Facebook · LinkedIn. Convert a Company Page to a Showcase Page · The only change in the URL will be the replacement of "company" to "showcase". · The Showcase Page will appear as an. Transfer ownership of workspaces you own · At the top-right of the workspace, select the Share button. · In the form, select the recipient's current sharing. If you are the current owner of the organization, you can transfer the ownership to an existing user: Visit the Ownership Transfer Section and click on the. While we won't delete the LinkedIn Page of an acquired organization, a super admin of Pages (parent and acquired) can request to add a notification to the. Request LinkedIn Page admin access to a LinkedIn Page to manage its components and be eligible to contact support with requests about your Page. Convert a Company Page to a Showcase Page · The only change in the URL will be the replacement of "company" to "showcase". · The Showcase Page will appear as an. Resetting your Account Owner's password is the quickest way to change ownership · Upload an HTML file to your oldest Site · Add a DNS TXT entry on your oldest. LinkedIn is a business and employment-focused social media platform that works through websites and mobile apps. It was launched on May 5, by Reid. After you rebrand or merge duplicate Pages, you can duplicate your followers or migrate associated members to the new Page. At LinkedIn, member experience is. If an asset, such as a Page, must be used by multiple regions or business units, the owner must share it with them. How to add Ad Accounts to your Linkedin. BusinessRocket cost-effective ownership change process ensures your company is always updated correctly with state and federal agencies. Before you can add a Page you don't have super admin access to, you must invite an existing Page super admin to your Business Manager. You can then request to. It's free to set up a LinkedIn company page where current and prospective customers as well as your employees can follow your content and share it with their.